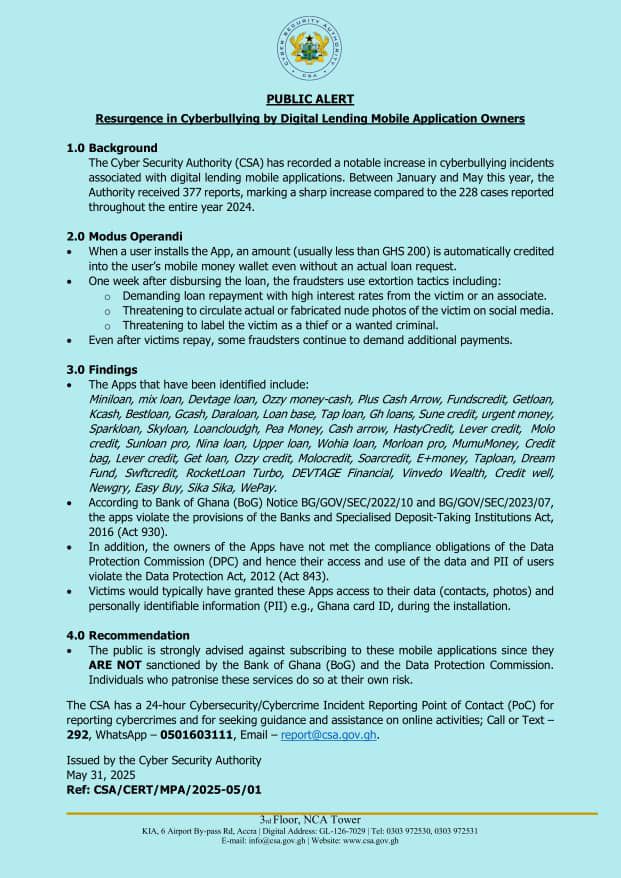

The Cyber Security Authority (CSA) has blacklisted over 40 unregulated mobile loan apps operating in Ghana for engaging in cyberbullying, blackmail, and intimidation tactics.

Between January and May 2025, the CSA recorded 377 complaints from users—an alarming rise from the 228 cases reported in 2024. Victims reported being harassed after taking loans from these apps, often without proper consent.

According to the CSA, these digital lending platforms operate outside legal and regulatory frameworks. They often lure users with unsolicited microloans and later resort to aggressive recovery methods, including: blackmail and defamation threats, unauthorized access to users’ phone data and sharing private information, photos, and contact lists with third parties

Some of the blacklisted apps include: Miniloan, Devtage Loan, Mix Loan, Ozzy Money-Cash, Plus Cash Arrow, Cash Arrow, FundsCredit, Lever Credit, Getloan, Upper Loan, Kcash, Bestloan, Gcash, DaraLoan, Loanbase, Taploan, Gh Loans, Sune Loans, Urgent Money, Sparkloan, Skyloan, Loancloudgh, Pea Money, and others.

“These applications disregard consumer protection laws and pose serious risks such as data breaches, harassment, and financial exploitation,” the CSA said in a public statement.

The Authority is urging Ghanaians to verify digital lending platforms before engaging with them and to report suspicious activity using its 24/7 cyber incident response system.